Increasing uptake of the Working Families Tax Credit in Washington

State of Washington Department of Revenue

August 2025 - September 2025

Why This Matters For Families

Across the country, millions of families are living paycheck to paycheck, struggling to afford their basics on low to moderate incomes. To support these families, 31 states and the federal government have instituted the Earned Income Tax Credit (EITC), which can provide families with thousands of dollars after filing their federal and state taxes. Tax credits have become a critical anti-poverty program in the United States, providing an essential source of cash for many American workers and families.

The 2021 expansion of the Child Tax Credit (CTC) in the American Rescue Plan reduced child poverty in the United States by 40% that year. However, accessing credits like the CTC is notoriously difficult as they are claimed during annual tax filing. The bipartisan, highly successful EITC reaches only 80% of eligible households nationwide, with lower-income, less-educated households being most likely to leave money on the table compared to other populations. The IRS estimates that roughly 20% of EITC-eligible and CTC-eligible individuals do not receive the credit payments they are owed — the federal EITC alone averaged $2,500 per return in 2022.

The Working Families Tax Credit is a unique tax credit that was introduced in Washington state in 2023 and designed to support at least 350,000 Washingtonians through improved financial stability. Low-income families in Washington carry one of the heaviest tax burdens compared to other states. This credit returns a portion of sales tax paid each year and is modeled after the federal Earned Income Tax Credit program. Because Washington doesn’t have a state income tax filing obligation, the Working Families Tax Credit depends on a separate application process. Over its first three years, the program distributed nearly $485 million.

Implementation Challenge

In its first two years, the Washington Department of Revenue (DOR) estimated about 51% and 53% of eligible households received the Working Families Tax Credit, respectively. Thanks to integration with commercial filing services, uptake jumped to about 80% in their third year. This spike in applications is incredibly promising and opens up opportunities, including:

Bringing awareness to people who received the credit in 2025 but may not know they’re still eligible for 2024 and 2023 credits as well.

Assessing and improving the overall user experience for applicants, in particular, looking for opportunities to reduce duplicate applications which add processing time and delay refunds.

Improving follow-through for the thousands of applicants who are asked to submit additional documentation to verify their eligibility and risk missing out on their refund if they don’t respond in a timely manner.

Better understand eligibility rules for the federal EITC, CTC, and Washington’s WFTC and consider how to build trust with individuals who file taxes without a social security number (like those with Individual Taxpayer Identification Numbers and others from marginalized communities).

Our Approach

The New Practice Lab and the Washington Department of Revenue worked together for 8 weeks from August 25, 2025 to October 17, 2025. We divided the work into three workstreams to begin to tackle persisting uptake challenges:

OBJECTIVE

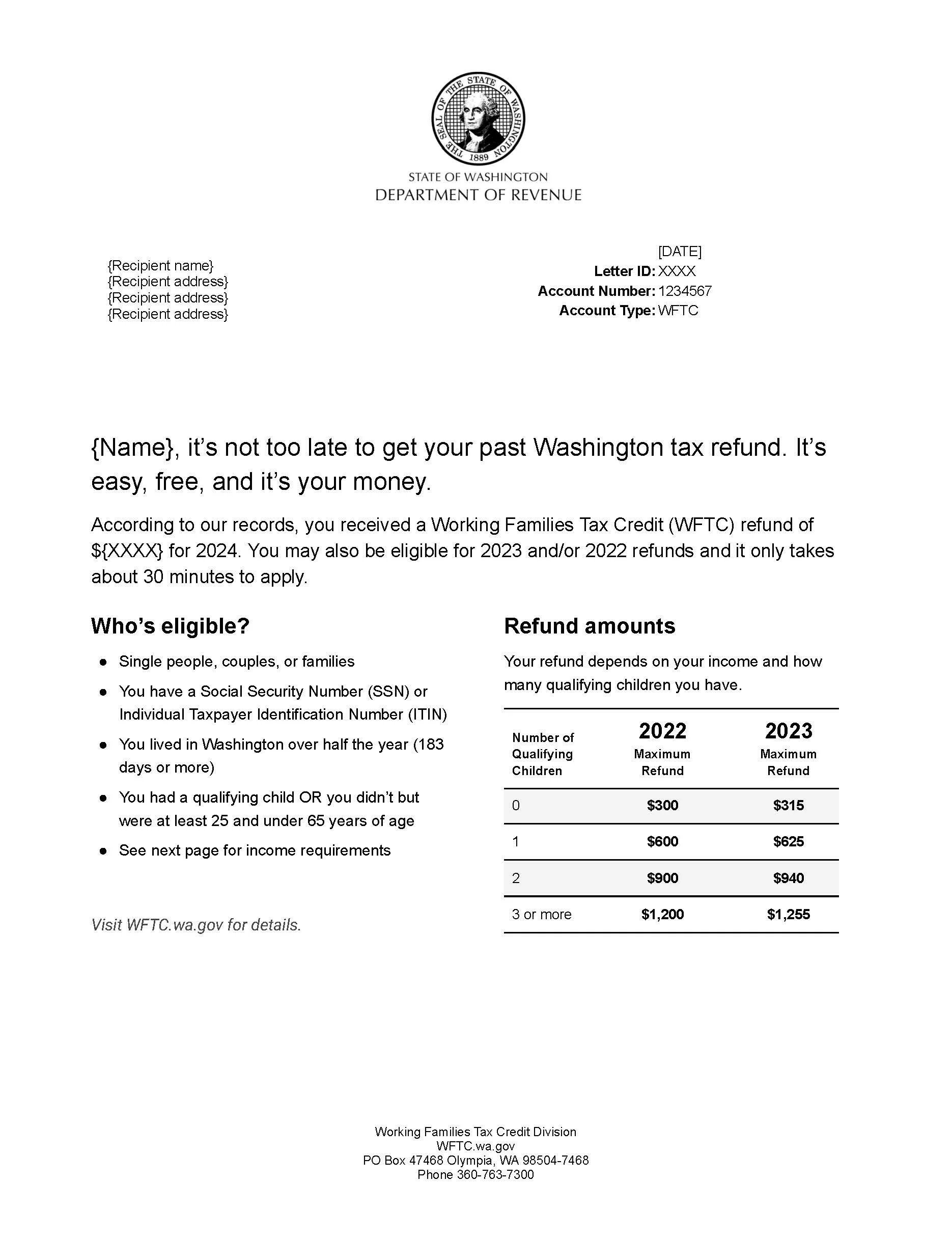

Develop an outreach letter to 2025 credit recipients who may be eligible for prior year tax credits to increase past years’ uptake.

WHAT WE DID

Understood outreach letter goals and constraints

Drafted outreach letter

Conducted usability research and refined letter draft based on insights

ORIGINAL OBJECTIVE

Improve the end-to-end user experience with a focus on reducing duplicate applications and improving follow-through on application completion when additional documentation is required.

WHAT WE DID

Conducted an expert review of the end-to-end filing experience and made recommendations

Drafted a new RFI (Request for Information) letter that employed more plain language descriptions of documents needed and reasons why

Conducted usability research and refined letter draft based on insights

ORIGINAL OBJECTIVE

Learn about eligibility rules for the federal EITC, CTC, and Washington’s Working Families Tax Credit and how to build trust with ITIN and marginalized communities

WHAT WE DID

Performed desk research using national literature to understand how other states manage cases where ITIN filers and other marginalized filers can access tax benefits

Identified actionable, customized strategies for the department to build trust among these populations

What We Learned

Through this engagement we were able to build on past New Practice Lab research and outreach initiatives to evolve our strategies to reach intermittent filers. We sharpened our letter writing approach and validated it with new usability testing where we did one-on-one interviews with Washingtonians to hear about their past filing experiences and get feedback about the new letters.

For example, our goals for the outreach letter were to balance being attention grabbing without reading like a scam, present complex eligibility information in a clear and concise manner, and to encourage readers to take action. All of the people we tested it with were able to accurately and confidently assess if they’re eligible and what they needed to do to claim the credit. One participant said very simply “This is a very clear letter. I think… someone would be able to take the information they need to apply.” That said, we did identify room for improvement to add more plain language descriptions and took a suggestion to add an official signature at the bottom to give it more authority.

These insights not only enabled us to support the immediate needs for the Washington DOR, but will also be the building blocks to a new tax credit uptake toolkit to distribute to other states.

Front of the sample letter

Back of the sample letter

Next Steps

The New Practice Lab is in ongoing discussions with Washington DOR staff about potential follow-on engagements aimed at further simplifying the filing experience.